Table of Contents

How Many Trading Days in a Year? This is one of the most common questions investors and traders ask while planning their market activities. Trading days are the foundation of financial markets, providing set periods for buying, selling, and analyzing investments. Understanding the total number of trading days helps investors manage their strategies, anticipate market closures, and stay prepared for key opportunities throughout the year.

Why are Trading Days important for investors?

Trading Days are essential for investors as they provide opportunities to buy and sell securities, analyze market trends, and make informed investment decisions. They ensure liquidity, help in fair price discovery, and allow investors to manage their portfolios effectively.

Definition of Trading Days

Trading days are the specific days when financial markets operate, allowing the buying and selling of stocks, bonds, and other securities. These days follow a set schedule determined by stock exchanges and regulatory bodies, ensuring consistency in market activities.

Average Number of Trading Days in U.S. Markets

The U.S. stock market, primarily represented by exchanges like the New York Stock Exchange (NYSE) and Nasdaq, operates for an average of 252 trading days per year. This number remains fairly consistent, though it can slightly vary due to how weekends and public holidays fall in a given year.

Factors Affecting the Count: Weekends and Holidays

The total number of trading days is reduced by weekends (Saturdays and Sundays) and market holidays observed by U.S. exchanges. Each year, approximately 104 weekend days and around 9–10 public holidays, such as Thanksgiving, Christmas, and Independence Day, result in market closures. Some years may see additional closures due to unexpected events, affecting the overall trading schedule.

What Constitutes a Trading Day?

A Trading day refers to any business day when financial markets are open for trading activities. Stock exchanges, including the New York Stock Exchange (NYSE) and Nasdaq, follow a structured schedule, operating Monday through Friday and closing on weekends and designated public holidays.

Key Features of a Trading Day

| Feature | Details |

|---|---|

| Standard Trading Hours | U.S. markets operate from 9:30 AM to 4:00 PM ET on regular trading days. |

| Pre-Market & After-Hours Trading | Some investors participate in extended trading sessions before 9:30 AM and after 4:00 PM ET. |

| Weekend Closures | Markets are closed on Saturdays and Sundays unless special trading sessions are announced. |

| Public Holiday Closures | U.S. exchanges observe 9–10 holidays annually, including Christmas and Independence Day. |

| Half-Day Trading | Some holidays, like Black Friday and Christmas Eve, have early market closures, typically at 1:00 PM ET. |

| Unscheduled Market Closures | Markets may close unexpectedly due to events like national emergencies or extreme financial instability. |

Average Number of Trading Days in U.S. Markets

The U.S. stock market has historically maintained an average of 252 trading days per year from 1990 to 2022. This consistency allows traders, investors, and financial analysts to structure strategies and forecast market behavior.

Yearly Trading Days Overview

Standard Range of Trading Days

The number of trading days in a given year typically falls within a range of 250 to 256 days. This variation is influenced by the specific placement of weekends and market holidays within the calendar. Despite these slight fluctuations, financial markets maintain a predictable structure, allowing investors and institutions to plan their strategies effectively.

Factors Affecting the Number of Trading Days

The primary factors influencing the number of trading days include weekends, as markets are generally closed on Saturdays and Sundays, accounting for roughly 104 non-trading days per year. Additionally, public holidays such as New Year’s Day, Independence Day, Thanksgiving, and Christmas contribute to reducing the total number of trading days, with some holidays shifting market closures to the nearest weekday if they fall on a weekend.

Market Consistency and Stability

Despite these minor variations, the consistency in the number of trading days plays a crucial role in maintaining market stability, liquidity, and financial planning. Investors, both institutional and retail, rely on this predictability to manage their portfolios, execute trades, and develop long-term investment strategies.

Factors the Number of Trading Days

The total number of trading days in U.S. financial markets is determined by several key factors, including weekend closures, public holidays, and unscheduled market closures. These factors play a crucial role in shaping the trading calendar, ensuring that markets operate efficiently while allowing for necessary breaks due to national events, emergencies, and regulatory decisions.

Weekend Closures

One of the most significant factors reducing the number of trading days is the standard weekend closure policy. U.S. stock markets, including the New York Stock Exchange (NYSE) and Nasdaq, remain closed on Saturdays and Sundays. Since there are 52 full weeks in a year, this results in approximately 104 non-trading days annually.

Public Holidays

In addition to weekends, U.S. markets also close for several federal holidays, further reducing the total number of trading days. The stock market observes holidays such as New Year’s Day (January 1), Independence Day (July 4), Thanksgiving Day (Fourth Thursday of November), and Christmas Day (December 25). On average, there are 9 to 10 market holidays per year, though the exact count varies slightly depending on how these holidays align with weekends.

Trading Days in Other Global Markets

The number of trading days per year differs across global financial markets due to regional public holidays, cultural observances, and exchange-specific schedules. While most stock exchanges follow a Monday-to-Friday schedule, the actual number of market trading days varies by country.

Regional Differences in Trading Days

| Region | Major Stock Exchange | Approximate Trading Days per Year |

|---|---|---|

| United States | NYSE, NASDAQ | 252–256 days |

| United Kingdom | London Stock Exchange (LSE) | 250–253 days |

| Europe (Germany, France, etc.) | Euronext, Deutsche Börse | 250–255 days |

| China | Shanghai & Shenzhen Stock Exchange | 240–245 days (Lunar New Year impacts) |

| Japan | Tokyo Stock Exchange (TSE) | 240–250 days (Golden Week, Emperor’s Birthday) |

| India | Bombay Stock Exchange (BSE), NSE | 245–250 days |

| Middle East | Tadawul (Saudi), Dubai Financial Market | 230–250 days (Friday-Saturday weekend) |

Factors Affecting Global Trading Schedules

The number of trading days in global financial markets varies significantly due to differences in public holidays, cultural observances, and weekend structures across regions. These variations influence trading activity, liquidity, and investment strategies for market participants operating across multiple financial centers. Understanding these factors is crucial for investors looking to optimize their trading strategies and manage their portfolios efficiently.

Public Holidays and Their Impact on Trading Days

One of the primary factors affecting the number of trading days in different countries is the observance of national public holidays. Each country has its own set of official holidays during which financial markets remain closed, reducing the total number of trading days available in a given year. For example, the United States stock market is closed on holidays such as New Year’s Day, Independence Day, and Thanksgiving, while the London Stock Exchange (LSE) observes different holidays, including Good Friday and Boxing Day.

Conclusion

Trading days are the foundation of financial market operations, determining when traders and investors can actively participate in buying and selling securities. In the United States, the stock market typically operates for about 252 trading days per year, but this number fluctuates due to factors such as weekends, public holidays, and unexpected closures.

The total number of trading days is significantly influenced by non-trading days, including Saturdays and Sundays, which automatically remove about 104 days from the yearly count. Additionally, public holidays like New Year’s Day, Independence Day, and Christmas further reduce available trading sessions. In rare cases, markets may also close due to unforeseen events such as economic crises, extreme weather conditions, or national emergencies, impacting the trading calendar.

FAQS (Frequently)

Which days are trading days?

Trading days are the days when financial markets are open for buying and selling stocks, bonds, and other instruments. In most countries, trading occurs Monday to Friday, excluding public holidays. Some Middle Eastern markets operate Sunday to Thursday instead.

What time is trading in Pakistan?

The Pakistan Stock Exchange (PSX) operates from 9:30 AM to 3:30 PM Pakistan Standard Time (PST), Monday to Friday. There is also a pre-open session from 9:15 AM to 9:30 AM for order placement. The market remains closed on weekends and public holidays.

What is the meaning of trading days?

Trading days refer to the designated days when financial markets are open for transactions. These exclude weekends and national holidays, ensuring regulated market activity. The number of trading days per year varies by country and market regulations.

What is day trading?

Day trading is a strategy where traders buy and sell financial instruments within the same trading day. Positions are closed before the market closes to avoid overnight risks. It requires quick decision-making, technical analysis, and risk management.

What is 3 trading days?

“3 trading days” refers to a time period of three consecutive market open days, excluding weekends and holidays. It is often used in settlement cycles, such as the T+3 rule, meaning transactions must be completed within three trading days.

How many traders in 7 days?

The number of traders in 7 days depends on market activity, investor participation, and trading volume. While financial markets operate 5 days a week, Forex markets run 24/5, allowing traders to operate continuously except on weekends.

Is day trading haram?

Day trading is a debated topic in Islamic finance, with scholars having different views. If it involves excessive speculation, high risk, or interest-based transactions, it may be considered haram (forbidden). However, ethical trading without riba (interest) or excessive gambling is permissible in some interpretations.

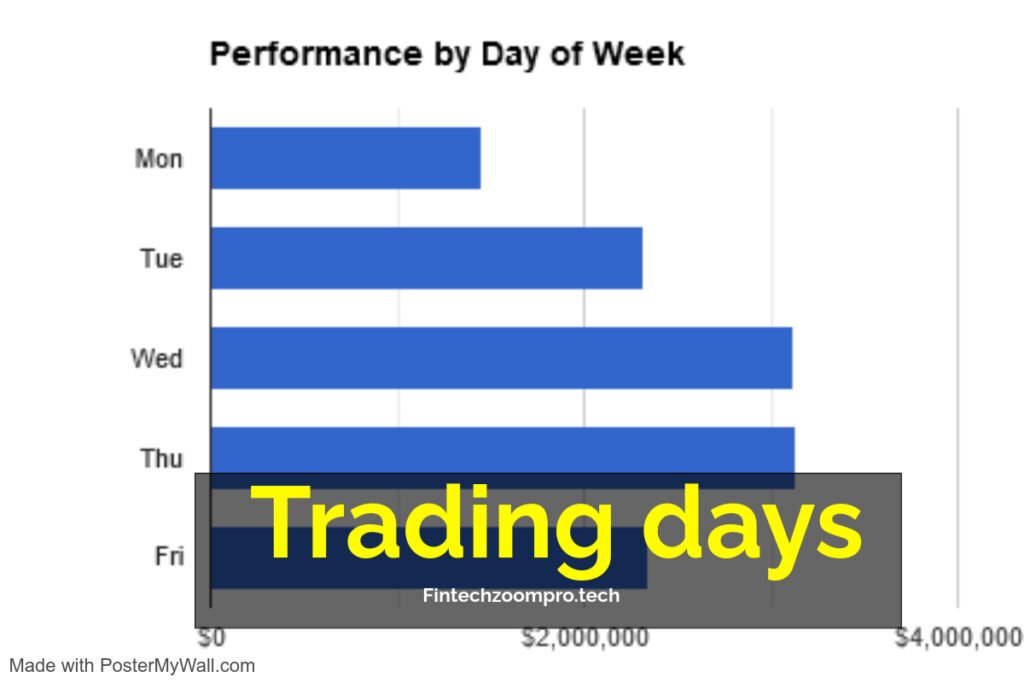

Which day is best for trading?

The best trading day depends on market trends, volatility, and liquidity. Studies suggest Tuesday to Thursday are optimal for trading due to stable market movements. Mondays may have unpredictable trends, while Fridays often see lower trading activity.