Table of Contents

Overview of Civista Bank

Civista Bank is a regional bank that has been serving communities since 1884. With its roots in Sandusky, Ohio, the bank has expanded its reach across Ohio, Southeastern Indiana, and Northern Kentucky.

Civista Bank offers a wide range of services to individuals, families, and businesses, ensuring that financial needs are met with care and expertise. Through its personalized banking approach and modern banking solutions, Civista Bank has earned a reputation for reliability and customer satisfaction.

Services Offered by Civista Bank

Civista Bank provides comprehensive financial services tailored to meet the needs of its diverse customer base. Whether you are an individual looking for personal banking options or a business owner seeking commercial financial support, Civista Bank offers a variety of services:

- Personal Banking: Including checking accounts, savings accounts, home loans, and personal loans to help manage personal finances effectively.

- Business Banking: Commercial lending, treasury management, and business accounts designed to support entrepreneurs and organizations.

- Wealth Management: Investment strategies, retirement planning, and trust services to help individuals plan for their future.

Digital Banking at Civista Bank

With a growing focus on digital services, Civista Bank ensures that customers have access to modern banking solutions that offer convenience and security.

Civista Bank’s digital banking services include online banking, mobile banking apps, and digital tools that allow customers to manage their accounts, pay bills, transfer funds, and access other banking features with ease.

This integration of technology helps customers stay connected and in control of their financial affairs anytime, anywhere.

Civista Bank’s Community Involvement

Civista Bank is not just a financial institution—it is an active participant in the communities it serves. The bank is committed to supporting local initiatives, promoting economic development, and engaging in charitable endeavors that positively impact its communities.

Through various programs and partnerships, Civista Bank plays a crucial role in fostering growth and improving the quality of life for residents and businesses in its service areas. The bank’s commitment to community involvement reflects its values of trust, integrity, and customer dedication.

Introduction

Civista Bank, established in 4, is a financial institution headquartered in Sandusky, Ohio.

Civista Bank

With a commitment to serving personal banking customers, Civista Bank offers a range of services tailored to meet individual financial needs. Operating across Ohio, Southeastern Indiana, and Northern Kentucky, the bank emphasizes personalized service and community involvement.

Key Points

- Comprehensive Personal Banking Services: Civista Bank provides various services, including checking and savings accounts, loans, and digital banking options.

- Customer-Centric Approach: The bank focuses on building long-term relationships with customers, emphasizing trust and personalized service.

- Technological Integration: Partnerships, such as with Hyland, enhance the bank’s digital capabilities, providing customers with efficient and secure online services.

Checking Accounts

Civista Bank offers several checking account options to suit different customer needs.

- Free Checking:

- No minimum balance required.

- No monthly service charge.

- eStatement is account standard.

- $50.00 minimum opening deposit.

- Compass Checking:

- Includes shopping, dining, and travel discounts with the BaZing mobile app.

- Cell phone protection up to $400 per claim ($800 per year).

- Identity theft aid with payment card fraud resolution and $2,500 in personal identity theft benefit.

- Low, flat monthly service charge of $8.00, waived for active military or veterans with monthly direct deposit of payroll or retirement benefits.

- eStatement is account standard.

- $50.00 minimum opening deposit.

- Star Checking:

- Interest-earning account with tiered rates.

- Includes benefits such as cell phone protection and identity theft services.

- No monthly service charge with a $1,500 minimum daily balance; otherwise, $10.00.

- eStatement is account standard.

- $50.00 minimum opening deposit.

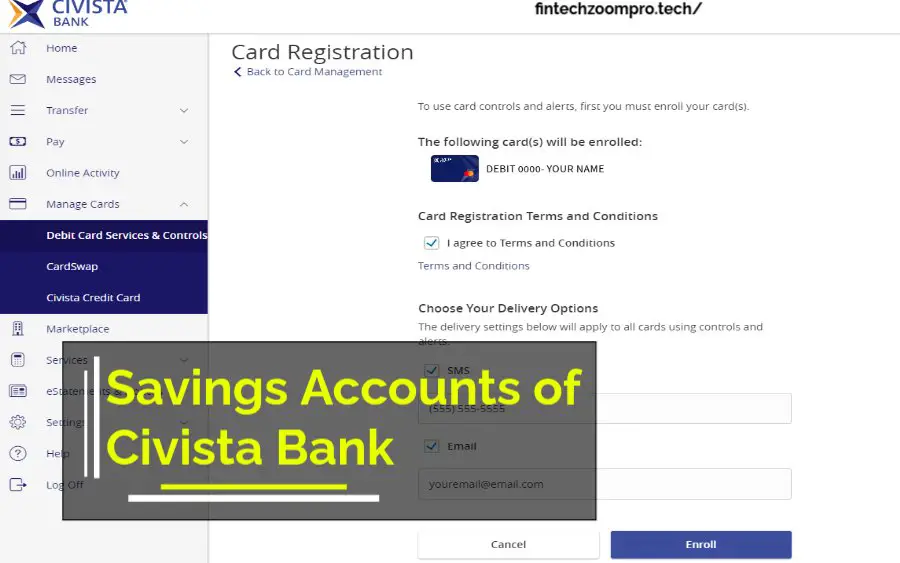

Savings Accounts of Civista Bank

A range of savings accounts is available to help customers achieve their financial goals.

- Regular Savings:

- Competitive interest rates.

- Easy access to funds.

- Low minimum balance requirements.

- Money Market Accounts:

- Higher interest rates with tiered balances.

- Limited check-writing capabilities.

- Ideal for customers looking to earn more while maintaining liquidity.

- Certificates of Deposit (CDs):

- Fixed interest rates for specified terms.

- Various term options to suit different savings goals.

- Early withdrawal penalties may apply.

Personal Loans Crypto-Legacy.app

Flexible loan options are provided to meet various personal financing needs.

- Auto Loans:

- Competitive rates for new and used vehicles.

- Flexible repayment terms.

- Pre-approval options available.

- Personal Lines of Credit:

- Revolving credit line for various personal expenses.

- Access funds as needed up to the credit limit.

- Interest charged only on the amount used.

- Home Equity Loans:

- Borrow against the equity in your home.

- Fixed interest rates and monthly payments.

- Potential tax benefits (consult a tax advisor).

Mortgage Services

Civista Bank assists customers looking to purchase or refinance homes.

- Fixed and Adjustable-Rate Mortgages:

- Options for stable or fluctuating interest rates.

- Various term lengths to fit financial plans.

- First-Time Homebuyer Programs:

- Specialized loans with lower down payment requirements.

- Educational resources to guide new buyers.

- Refinancing Options:

- Opportunities to lower existing mortgage rates.

- Cash-out refinancing for accessing home equity.

Digital Banking

Convenient online and mobile banking services are available for account management.

- Online Bill Pay:

- Schedule and pay bills electronically.

- Set up recurring payments for regular expenses.

- Mobile Check Deposit:

- Deposit checks using the mobile app.

- Secure and quick processing.

- Account Alerts and Notifications:

- Customize alerts for account activity.

- Stay informed about balances and transactions.

- External Funds Transfers:

- Move money between Civista accounts and accounts at other U.S. financial institutions.

- Manage funds with inbound and outbound transfer capabilities.

- CardSwap:

- Update payment information for multiple online services in one place.

- Streamline management of subscriptions and digital payments.

Wealth Management

Services aimed at helping customers plan and manage their finances effectively.

- Investment Advisory:

- Personalized investment strategies.

- Portfolio management services.

- Retirement Planning:

- Assistance with 401(k) rollovers and IRAs.

- Strategies to meet retirement income goals.

- Trust Services:

- Estate planning and administration.

- Trustee services for managing assets.

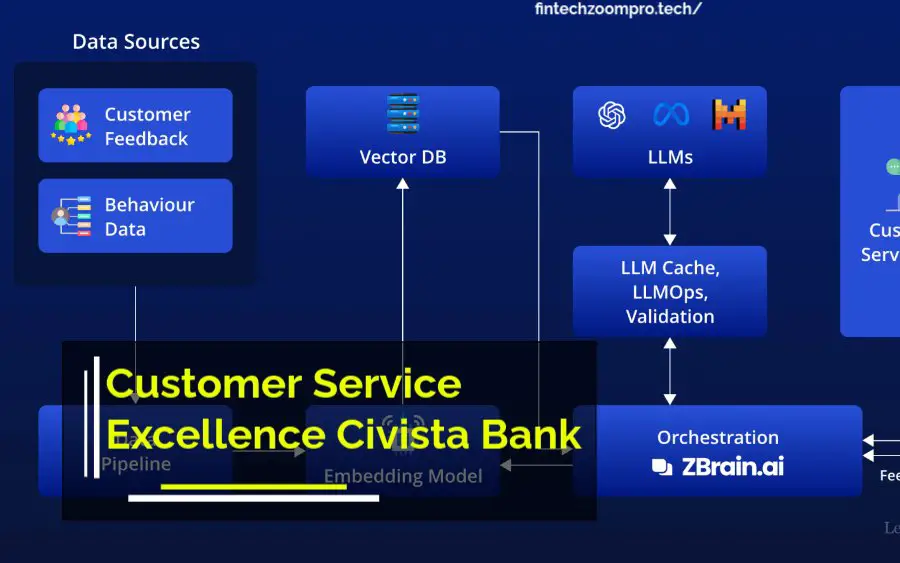

Customer Service Excellence Civista Bank

Civista Bank is committed to providing exceptional customer support.

- Personalized Banking Experience:

- Dedicated representatives to assist with individual needs.

- Focus on building long-term customer relationships.

- Community Involvement and Support:

- Active participation in local events and initiatives.

- Support for community development projects.

Frequently Asked Questions (FAQs)

What types of personal banking accounts does Civista Bank offer?

- Civista Bank provides a variety of personal banking accounts, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), each designed to meet different financial needs and goals.

How can I access my Civista Bank account online?

- You can access your Civista Bank account online by enrolling in their online banking service through their official website. Once enrolled, you can log in to manage your accounts, pay bills, and perform other banking activities.

Where can I find the nearest Civista Bank branch?

- To locate the nearest Civista Bank branch, you can use the branch locator feature on their website, which allows you to search for branches and ATMs based on your location.

What is Civista Bank’s routing number?

- Civista Bank’s routing number is 041201635. This number is used for various banking transactions, including direct deposits and electronic fund transfers.

Does Civista Bank offer mobile banking services?

- Yes, Civista Bank offers mobile banking services through their mobile app, allowing customers to manage accounts, deposit checks, and perform other banking tasks from their mobile devices.

How can I reset my Civista Bank online banking password?

- If you’ve forgotten your online banking password, you can reset it by visiting the Civista Bank website, clicking on the “Forgot Password” link, and following the provided instructions to regain access to your account.

What are the business hours for Civista Bank branches?

- Business hours for Civista Bank branches may vary by location. It’s recommended to check the specific branch hours using the branch locator on their website or by contacting the branch directly.

How do I apply for a personal loan with Civista Bank?

- To apply for a personal loan, you can visit a local Civista Bank branch or apply online through their website, where you’ll find information on loan options and the application process.

Is Civista Bank FDIC insured?

- Yes, Civista Bank is a member of the Federal Deposit Insurance Corporation (FDIC), which means deposits are insured up to the applicable limits.

What should I do if my Civista Bank debit card is lost or stolen?

- If your debit card is lost or stolen, you should immediately contact Civista Bank’s customer service to report the loss and request a replacement card.

Does Civista Bank offer mortgage services?

- Yes, Civista Bank provides mortgage services, including home purchase loans, refinancing options, and programs for first-time homebuyers.

How can I enroll in Civista Bank’s online banking?

- To enroll in online banking, visit Civista Bank’s website and follow the enrollment instructions, which typically involve verifying your identity and setting up login credentials.

Are there fees associated with Civista Bank’s checking accounts?

- Fees for checking accounts vary depending on the specific account type. It’s advisable to review the account disclosures or speak with a bank representative for detailed information on any associated fees.

Can I set up direct deposit with my Civista Bank account?

- Yes, you can set up direct deposit by providing your employer with your Civista Bank account number and routing number.

What services are available through Civista Bank’s mobile app?

- Through Civista Bank’s mobile app, customers can check account balances, transfer funds, deposit checks, pay bills, and locate branches and ATMs.

How do I contact Civista Bank’s customer service?

- You can contact Civista Bank’s customer service by calling their toll-free number, visiting a local branch, or using the contact form on their website.

Does Civista Bank offer financial planning or wealth management services?

- Yes, Civista Bank offers wealth management services, including investment advisory, retirement planning, and trust services, to help customers manage their financial goals.

What is the process to open a new account at Civista Bank?

- To open a new account, you can visit a Civista Bank branch or start the process online by selecting the desired account type and completing the application with the required personal information.

Are there ATM fees for Civista Bank customers?

- Civista Bank offers access to a network of ATMs. While transactions at Civista Bank ATMs are typically free, fees may apply for using out-of-network ATMs. It’s best to review the account terms or contact the bank for specific fee information.

How secure is Civista Bank’s online banking platform?

- Civista Bank employs advanced security measures, including encryption and multi-factor authentication, to protect customers’ online banking information and ensure secure transactions.

Conclusion

In conclusion, Civista Bank offers a comprehensive suite of personal banking services designed to meet the diverse financial needs of its customers. From checking and savings accounts to personal loans and digital banking solutions, the bank is committed to providing accessible and secure financial services.

By leveraging technology and maintaining a customer-centric approach, Civista Bank ensures that clients have the tools and support necessary to achieve their financial goals. Whether you’re looking to open a new account, apply for a loan, or manage your finances online, Civista Bank is dedicated to being a trusted partner in your financial journey.

Civista Bank is a well-established financial institution that offers a broad range of services designed to meet the needs of both personal and business customers. With a long-standing commitment to providing excellent customer service and supporting community development, Civista Bank continues to be a trusted partner for financial solutions.

Whether you’re looking to manage personal finances, grow your business, or plan for the future, Civista Bank offers the tools, resources, and support to help you achieve your goals. Its focus on customer satisfaction, combined with modern banking technology, ensures that clients have convenient and secure access to their financial services.